Another week of 'Safer-At-Home' has passed and the it was a wild week in the markets, starting with the front-end, oil futures contracts trading at negative prices, and ending with equities up 1% on Friday. We still finished the week down 1% and the Volatility Index (VIX) sits at 35 (it would float around 12-15 in 2019 for some context). So while the PE on the S&P is hovering around its 25 year average, as a whole (at 15X), there are pockets that are dislocated, undervalued, or trading like Warren Buffet's famous quote, "Markets in the short term are like voting machines, (and move on public opinion and sentiment), but over the long term markets are a weighing machine (and value businesses on fundamentals like earnings and quality of management)". The VIX reflects these short terms movements and helps with price discovery, expected results, and liquidity, which all play into the long-term fundamentals.

A Short Econ 101 Lesson

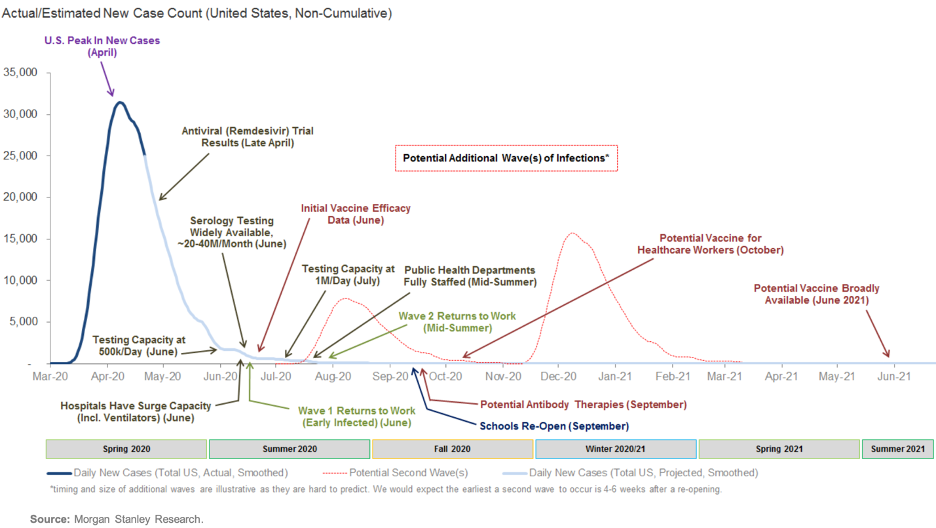

Markets are a discounting mechanism, after all, a PE of 15X, means the price is worth 15 times its current earnings, in today's dollars. We then must assess the probability of achieving those results, by management in place with the goods and/or services the companies sell. The Equities markets love to project at least 6 months-1 year in advance of what 'they' think is going to happen. So, if I am asked why is the S&P floating at its 25 year average in today's crazy world, the markets (all the participants and the experts they pay), are currently assessing this will start to return to normal in the next 6 months to 1 year (since the markets like to project in advance). So how did 'they' make such an assessment? Here is a great chart of when most expect a return a general normal. This is not nuanced with procedural issues, and reflects the operational hurdles that seem to exist by channel checking industry experts at each level. Obviously everyone wants it beforehand, but, the question is what is realistic.

Knowing markets move different, and in advance, of the general economy (as depicted above), the PE seems to be consistent with where people think we will emerge. But I have cautioned many on the phone and Zoom call it will be a volatile time.

The Plateau May be worse than the Plague (in the Market's Case)

As you are very aware, there is a varying of opinion on when to open the economy back up, and this has been an issue we were worried about and discussed since before the peak. Just as people debated over Safer-At-Home vs other Herd Immunity options (and still do), we knew this would rear its head again when re-opening, and the VIX and market moves would reflect such. While 90% of America willing stayed at home, many are now wanting to return, others are not. It's a risk preference, not too different than the ones we use to gage investment profiles. This will continue for a bit, as we expect some flair ups, as with Singapore.

All this being said, our country will have some changes that will be long lasting. Trends or behaviors that were already beginning or recently started tend to get exasperated during downturns and stick, such as online shopping, and video chats. I expect sterilization/cleanliness to be habit forming, and or regulated to a higher level. I saw a survey Friday that 24% of new Work-From-Home (WFH) employees plan to keep doing it to some degree afterwards. This will put pressure on CRE, and other things too, but also give rise to a new crop of things.

Last, at TBH Franklin, as we WFH we have been exploring better ways to engage, with clients, via things like Zoom (if you are interested let me know), sharing our Calendar vie Calendly (will roll out soon), internally using MS Teams for communication and chat, and a new platform for emails and marketing through our financial planning software E-Money. So you may see some changes to this format fairly soon! We hope you enjoyed the teaks to the website too.