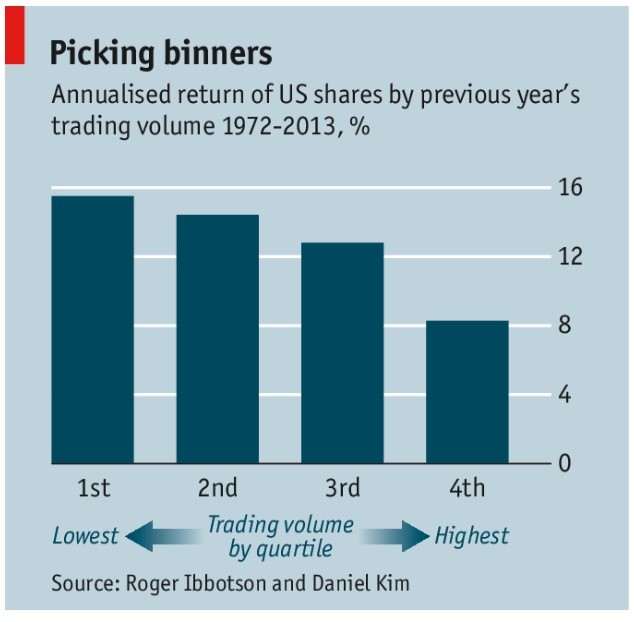

A recent study a shed light on something TBH Franklin has wondered about for years. How do the popular stocks perform over the long haul? The study pointed out stocks that were the most active by volume by its market value underperformed the following year, and the least active by volume per its market value outperformed the following year, according to a recent study by The Journal of Portfolio Management.

So what are the reasons for the popularity effect? Well unlike other assets when demand rises, the prices rises and it draws more people into the stock “to try to make some money.” There is a saying for these momentum trades, “go with the trend, until it bends.” While these trades may have a short term positive, the long term effect is detrimental to a portfolio. It is best to find stocks that have great fundamentals, a great management team, that are trading at a discount to their intrinsic value, then buy.

If you have questions about this or any other portfolio questions do not hesitate to reach out to us, we love this stuff, and would love to talk about it.